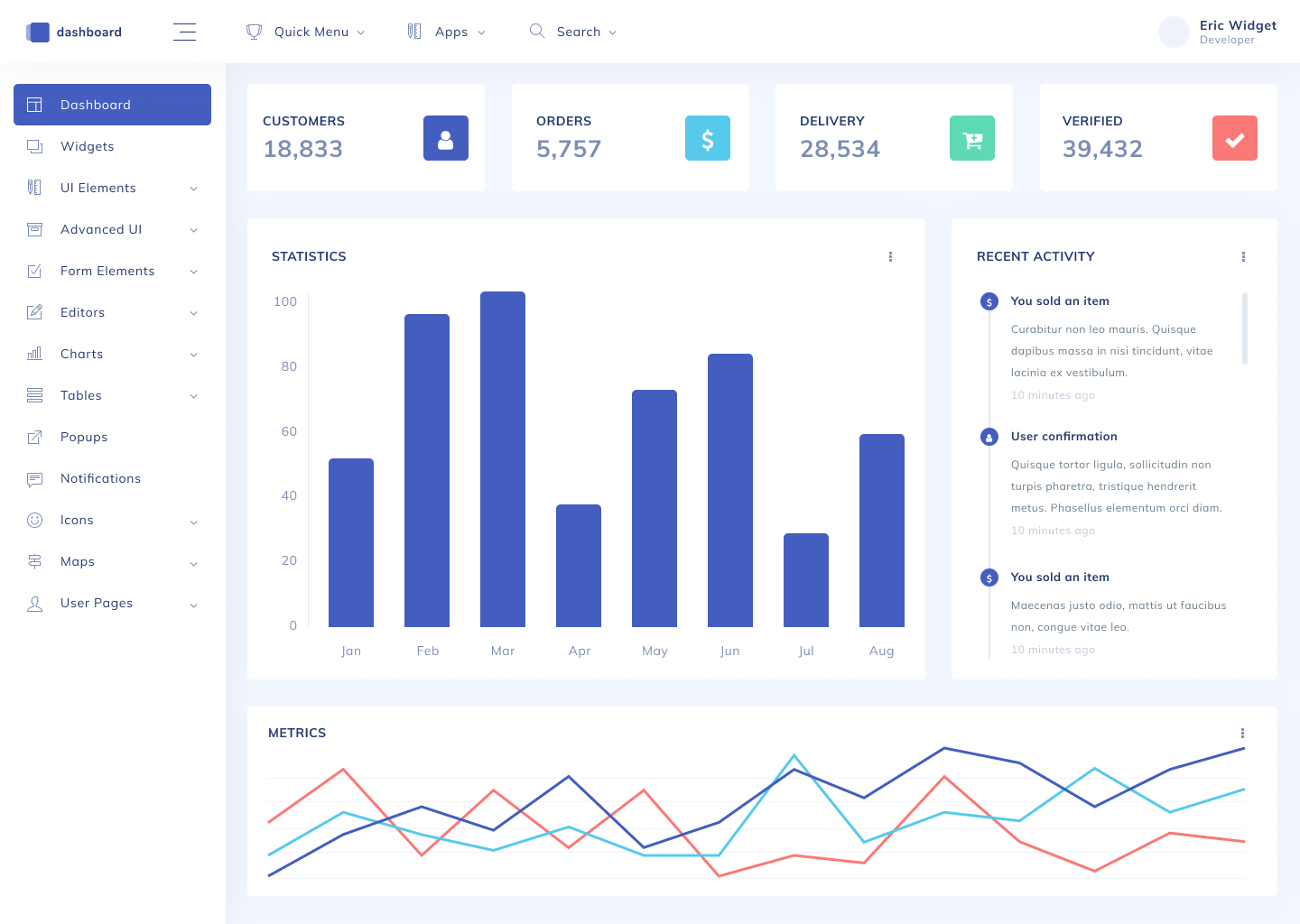

100% control & integrations

Start Your PSP Business

Get comprehensive software for your business, covering 100% of your and your Gateway or your merchant needs !!!

The Idea

Gain full control over your business and freedom in how your business evolves

- Get full control over your merchants’ data and tech infrastructure.

- Be free from vendor lock by integrating with any providers.

- Develop your business with a fully brandable white-label payment platform.

- Seamlessly transform to an acquiring bank and get free access to all necessary functionality.

- Enrich your basic capabilities with direct Visa/Mastercard connectors.

- Become a payment orchestrator or aggregator with unlimited capabilities for integration.

Solutions

Multi-acquiring & Multi-currency, Smart routing & Cascading

- Reduce fees by creating multiple routes for different transaction types.

- Increase conversion rates with cascading functionality for declined transactions.

- Provide competitive commissions for your merchants.

- Gain another source of income by setting up a fee for currency conversion.

The Idea

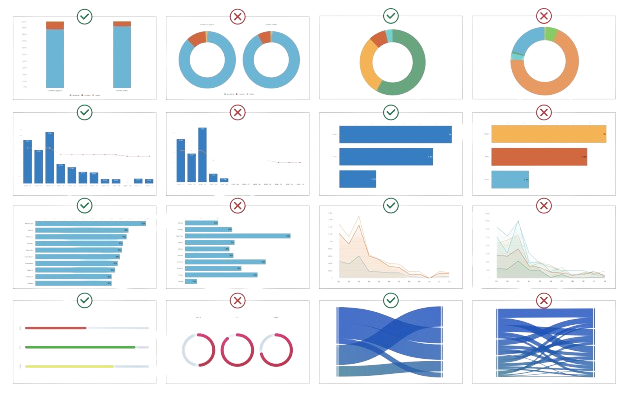

Limits functionality and AI-powered antifraud engine

- Prevent fraudulent transactions with powerful scoring features and stay reliable for payment systems and merchants.

- Automate compliance with the terms of your contracts with merchants.

- Maximize conversion rates with self-learning antifraud algorithms that analyze payer behavior and existing fraud reports, and reroutes suspicious transactions.

Solutions

Allow your merchants to start selling immediately

- Pre-built templates for different niches

- Simple customization in a visual editor

- A robust product search including search by characteristics

- Custom domain URLs

- SEO tools

- Popular & recommended products

- Multivariate products and custom unit groups

- Available products in stock

- One-click purchase option

- Multi-language

Featured

Provide an all-in-one business solution !!!

Signing in and fast onboarding

Use our automated KYC onboarding tool uniting cutting-edge third-party identification and screening services to automate AML compliance and gather all the necessary data for merchant account opening and card issuing.

FAQ

Frequently Ask Questions

Merchants can configure a website template, payment methods, brand style, languages, store information, work schedule, locations, and social.

We have tools for setting up unit groups, characteristics, special marks, and quantity for different SKUs and adding multivariate products, manually or by file import. Your merchants can also export their databases. An example of a stock management feature is they can show customers out-of-stock products and available amounts.

Merchants are able to add their teams and provide each person with their own app, and custom permissions. They also can connect sellers with orders and track personal statistics.

Let your merchants add new customers manually, or with online shop orders, identifying them by phone number. They can also check customers’ order history and loyalty status, handily give or take points, as well as support users via in-app chat.

Your merchants are able to acquire online payments via a fully-functional payment page embedded into the checkout. In-app order omnichannel management allows them to cancel or apply customers’ orders after the product availability check.

Merchants and their sellers can send or reserve orders via the in-app shop or via scanning barcodes. They can contact customers in person or by phone. Connecting orders with clients they are able to apply points or other loyalties. After payment, the system automatically generates a fiscal receipt.